Inventoriable Costing Methods

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

Inventoriable costing methods calculate changes in an item’s value when it’s sold and received. To determine an item’s next cost, you need to use one of three inventoriable costing methods.

With the first in, first out (FIFO) costing method, TireMaster uses the cost of the first item received as the next cost of the item.

With the last in, first out (LIFO) costing method, TireMaster uses the cost of the last item received as the item’s next cost.

With the average (AVG) costing method,TireMaster averages the various costs at which an item is received and then uses that average as the item’s next cost.

To define the inventoriable costing method, you need to set a system control. The costing method that you choose is used to track the cost of all inventoriable items.

To set the inventoriable costing method

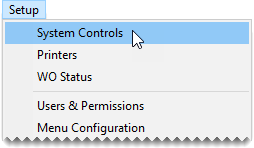

| 1. | Select Setup > System Controls. The System Controls screen opens. |

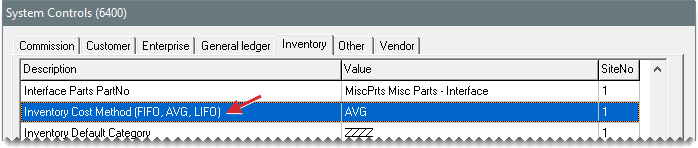

| 2. | Click the Inventory tab. |

| 3. | Select Inventory Cost Method (FIFO, AVG, LIFO) and press Enter. |

| 4. | Select one of the following: |

FIFO

AVG

LIFO

| 5. | Click OK. |

| 6. | Close the System Controls screen. |