FET Handling for POs and Receivings

If federal excise tax is assessed for an item, you need to track the cost of FET each time the item is received. When you place an item on a purchase order or receiving document, TireMaster uses one of the following values as the FET:

The average of the item’s federal excise tax

The FET from the item’s last receiving

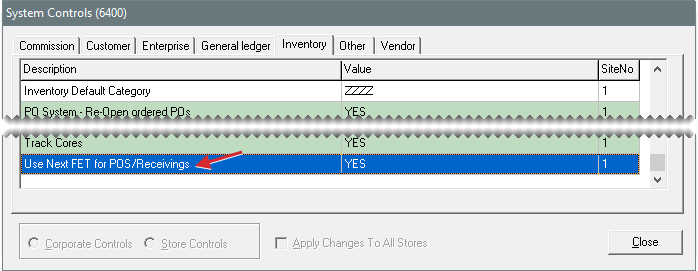

To define which value to use, you need to set the system control Use Next FET for POS/Receivings. In addition to defining how FET is handled on purchase orders and receivings, this setting also determines which value to use as the FET for items added to quotes or work orders.

Note: By default, TireMaster uses the average cost of an item’s federal excise tax as its FET.

To set FET handling

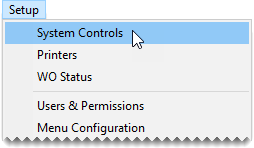

| 1. | Select Setup > System Controls. The System Controls screen opens. |

| 2. | Click the Inventory tab. |

| 3. | Select Use Next FET for POS/Receivings and press Enter. |

| 4. | Select one of the following: |

To use the average cost of an item’s federal excise tax, select YES.

To use the FET from an item’s last receiving, select NO.

| 5. | Click OK. |

| 6. | Close the System Controls screen. |

Note: You can view both the average cost of an item’s FET and the last FET in an item’s inventory record (on the Site Prices and Quantity screen). The last FET is the amount of federal excise tax you paid for the item the last time it was received, and the next FET is the average cost of the item’s federal excise tax.