Sales Tax Collection Methods

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

You can base your sales tax collections on one of the following:

The default tax levels for your store

The tax levels assigned to individual customers

Basing tax collections on the levels assigned to individual customers is sufficient if your sales tax requirements are minimal, such as if you only need to collect state sales tax or if all of your stores are located within the same tax jurisdiction.

If you need to collect taxes for a variety of government agencies, such as the state and multiple cities that each have different tax rates, you can base your sales tax collections on the default tax levels for your store. Basing collections on your store’s levels, helps to ensure that you collect enough sales tax to satisfy the requirements of all of the various government agencies.

Although this scenario typically occurs in TireMaster Corporate environments, where customers are added at various locations with differing sales tax requirements, the option to base sales tax on store levels can also be used in TireMaster Plus and TireMaster Point of Sale systems.

You can define how sales tax is collected by setting a system control.

To define how sales tax is collected

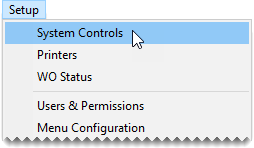

| 1. | Select Setup > System Controls. The System Controls screen opens. |

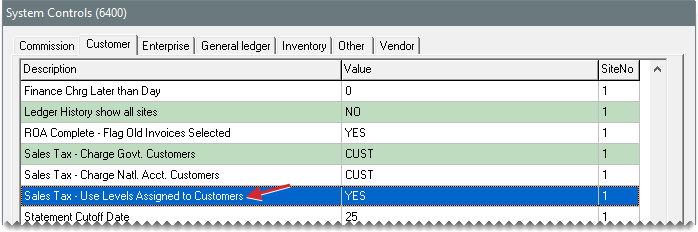

| 2. | Click the Customer tab. |

| 3. | Select Sales Tax - Use Tax Levels Assigned to Customers and press Enter. |

| 4. | Do one of the following: |

To base your sales tax collections on the default parts and labor tax levels for your store, select No.

To base your sales tax collections on the tax levels assigned to individual customers, select Yes.

| 5. | In TireMaster Corporate, repeat steps 3 and 4 until the control has been set for all sites. |

| 6. | Close the System Controls screen. |