Exclude FET from Sales Tax

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

By default, the sales tax for quotes and work orders is calculated based on the parts price, labor price, and federal excise tax for items. However, if you do business in a state where charging sales tax on FET is optional or prohibited, you can exclude it from sales tax calculations by changing a control setting.

To exclude FET from sales tax

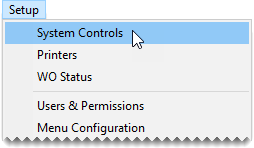

| 1. | Select Setup > System Controls. The System Controls screen opens. |

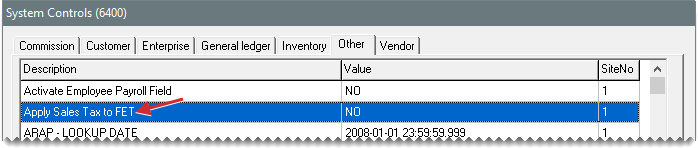

| 2. | Click the Other tab. |

| 3. | Select Apply Sales Tax to FET, and press Enter. |

| 4. | Select No and click OK. |

| 5. | Close the System Controls screen. |