Sales Tax Rounding Account

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

The sales tax rounding account is a GL account that’s used in to track the amount of sales tax that’s rounded off during sales tax calculations.

When calculating sales tax, TireMaster temporarily extends the tax amount for each item by two digits. Using the extra digits ensures that the sales tax total for each of the items equals the sales tax total for the invoice. Once the sales tax total is calculated, the extra digits are no longer needed. As a result, the amount of tax that posts to the general ledger matches the amount of tax actually charged.

To define the sales tax rounding account

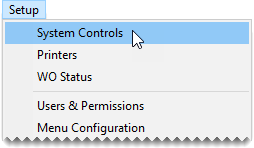

| 1. | Select Setup > System Controls. The System Controls screen opens. |

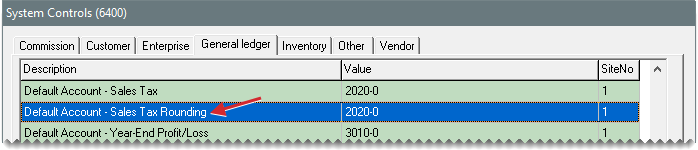

| 2. | Click the General Ledger tab. |

| 3. | Select Default Account - Sales Tax Rounding and press Enter. The Chart of Accounts screen opens. |

| 4. | Select the account you want to use to track sales tax rounding, and click OK. |

| 5. | Close the System Controls screen. |