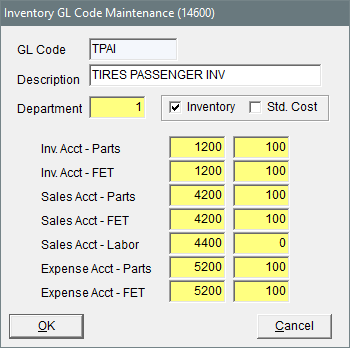

Inventory GL Code Maintenance Screen

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

The Inventory GL Code Maintenance screen is used for setting up and managing GL codes.

|

Item |

Description |

|

GL Code |

Lets you type a new GL code (up to four letters). Once you save a GL Code, you cannot modify it (although you can change its other settings). |

|

Description |

Lets you type a description for the GL code. |

|

Department |

Lets you specify the department for the items that a GL code will be assigned to. |

|

Inventory |

Defines whether the GL code is for inventoriable items. |

|

Std. Cost |

Defines whether to post items to the general ledger at a standard cost. Clearing the check box prevents items from posting to the GL at a standard cost. Note: Standard cost is a method of forcing TireMaster to maintain a steady cost for an item because its true cost often fluctuates.

|

|

Inv. Acct – Parts |

Lets you specify which asset account to post to when an item is bought, sold, or included in other transactions. |

|

Inv. Acct – FET |

Lets you specify which asset account to use for posting federal excise tax. |

|

Sales Acct – Parts |

Lets you specify which income account to use for posting the parts price when an item is bought, sold, or included in other transactions. |

|

Sales Acct – FET |

Lets you specify which sales account to use for posting federal excise tax. |

|

Sales Acct – Labor |

Lets you specify which income account to use for posting the labor price when an item is bought, sold, or included in other transactions. |

|

Expense |

Lets you specify which account the item's cost will post to when an item is bought, sold, or included in other transactions. |

|

Expense |

Lets you specify which expense account to use for posting federal excise tax. |

|

OK |

Saves changes and closes the screen. |

|

Cancel |

Closes the screen without saving changes. |