Chart of Accounts

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

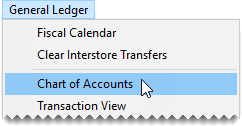

The chart of accounts lists all of the accounts in your general ledger. Access to the chart of accounts varies, depending on your TireMaster system.

If you're running TireMaster Point of Sale,

If you're running TireMaster Plus,

If you're running TireMaster Corporate,

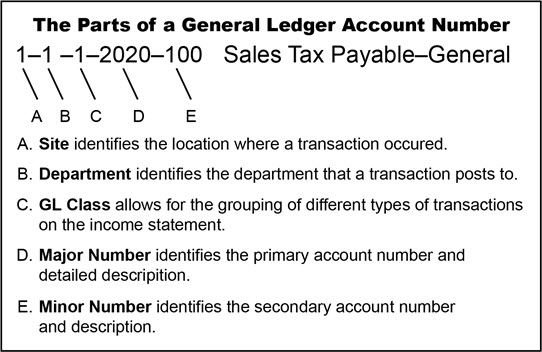

In TireMaster, general ledger account numbers are made up of five different parts. Each part of the account number provides different information and defines how to post transactions to the general ledger.

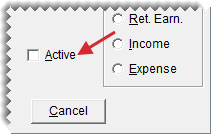

The chart of accounts in TireMaster uses five types of accounts. The code (shown in the Type column on the Chart of Accounts screen) defines the account type ().

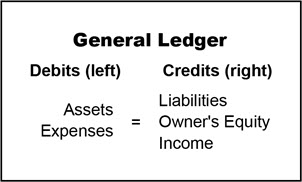

Depending on the transaction that’s performed, the balance of an account increases or decreases. Some accounts are known as debit accounts, and others are known as credit accounts. Debits are used to record an increase in asset and expense accounts, while credits are used to record an increase in liability, owner’s equity, and income accounts.

|

Account Type |

Debit |

Credit |

|

Asset |

+ |

- |

|

Liability |

- |

+ |

|

Owner’s Equity |

- |

+ |

|

Income |

- |

+ |

|

Expense |

+ |

- |

For your general ledger to be in balance, the amount in the debit accounts on the left side must equal the amount in the credit accounts on the right side ().

New TireMaster systems include a standard chart of accounts

An asset is something that you own that has a dollar value. Asset accounts include cash, accounts receivable, and inventory accounts.

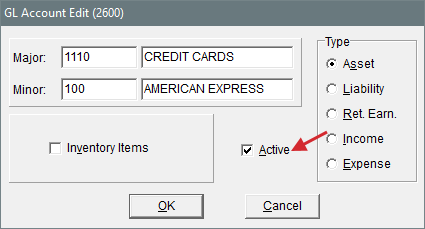

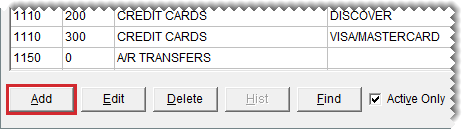

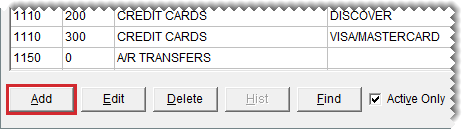

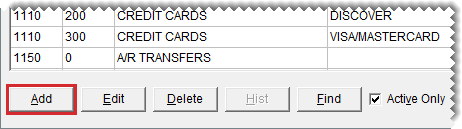

To add an asset account

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Click Add. The GL Account Edit screen appears. |

| 3. | Type the major account number and primary description for the new account. |

| 4. | Type the minor account number and secondary description for the new account. |

| 5. | Under Type, select Asset. |

| 6. | If the new account is for inventoriable items, select the Inventory Items check box. Otherwise, leave it blank. For more information, see Add an Inventory Item. |

| 7. | Make sure the Active check box is selected. |

| 8. | To save the new account, click OK. |

Liabilities are debts that you owe. Liabilities include your vendor accounts, loans, and taxes.

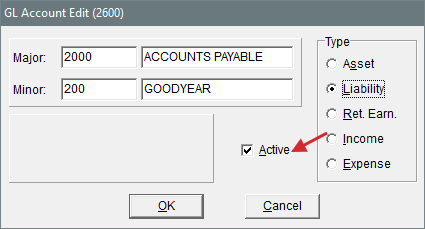

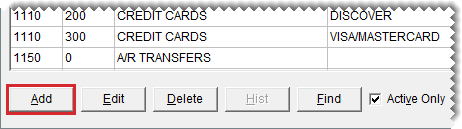

To add a liability account

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Click Add. The GL Account Edit screen opens. |

| 3. | Type the major account number and primary description for the new account. |

| 4. | Type the minor account number and secondary description for the new account. |

| 5. | Under Type, select Liability. |

| 6. | Make sure the Active check box is selected. |

| 7. | To save the new account, click OK. |

Equity is the difference between the total assets and total liabilities of a business. Equity accounts include your capital and retained earnings accounts.

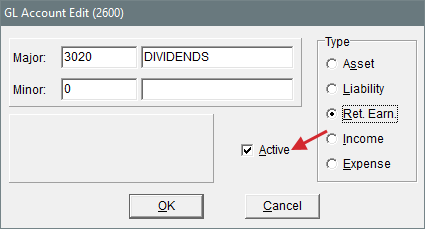

To add an equity account

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Click Add. The GL Account Edit screen opens. |

| 3. | Type the major account number and primary description for the new account. |

| 4. | Type the minor account number and secondary description for the new account. |

| 5. | Under Type, select Ret. Earn. |

| 6. | Make sure the Active check box is selected. |

| 7. | To save the new account, click OK. |

Income is any revenue that comes from the sale of goods and services or from other sources. Your income accounts are mainly sales accounts.

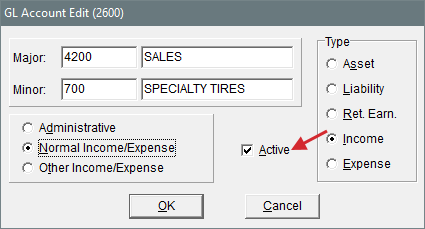

To add an income account

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Click Add. The GL Account Edit screen opens. |

| 3. | Type the major account number and primary description for the new account. |

| 4. | Type the minor account number and secondary description for the new account. |

| 5. | Under Type, select Income. |

| 6. | To define which section of the income statement will include information about the new account, select one of the following: |

Administrative

Normal Income/Expense

Other Income/Expense

| 7. | Make sure the Active check box selected. |

| 8. | To save the new account, click OK. |

An expense is a decrease in equity that comes from the cost of materials and services used to produce income. Examples of expenses are the cost of inventory, loan fees, and insurance.

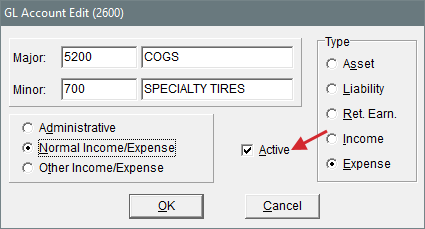

To add an expense account

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Click Add. The GL Account Edit screen opens. |

| 3. | Type the major account number and primary description for the new account. |

| 4. | Type the minor account number and secondary description for the new account. |

| 5. | Under Type, select Expense. |

| 6. | To define which section of the income statement will include information about the new account, select one of the following: |

Administrative

Normal Income/Expense

Other Income/Expense

| 7. | Make sure the Active check box selected. |

| 8. | To save the new account, click OK. |

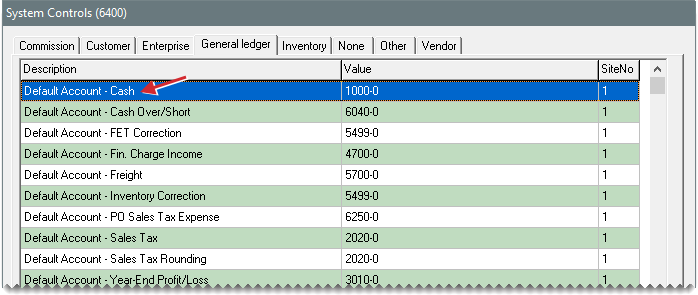

Default Account - Cash

Default Account - Cash Over/Short

Default Account - FET Correction

Default Account - Finance Charge Income

Default Account - Freight

Default Account - Inventory Correction

Default Account - PO Sales Tax Expense

Default Account - Sales Tax

Default Account - Sales Tax Rounding

Default Account - Year-End Profit Loss

You can leave the default settings as is or assign different accounts to the controls.

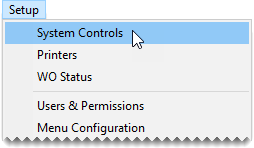

To set a default general ledger account

| 1. | Select Setup > System Controls. The System Controls screen opens. |

| 2. | Click the General Ledger tab. |

| 3. | Select the control for the default account that you want to set and press Enter. The Chart of Accounts screen opens. |

| 4. | Select an account, and click OK. |

| 5. | To set additional controls for default accounts, repeat steps 3 and 4. |

| 6. | Close the System Controls screen. |

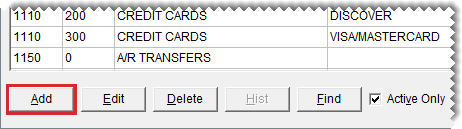

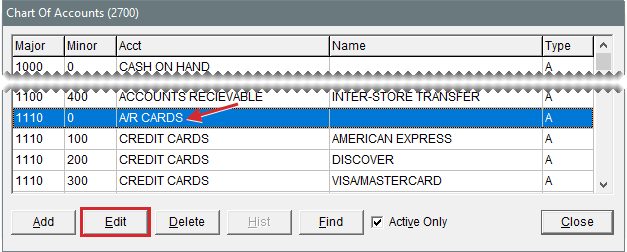

If your chart of accounts includes rarely-used and unused accounts, you can make it easier to manage by deleting those accounts or making them inactive.

If you no longer use a general ledger account, you can make it inactivate. By making an account inactive, you can exclude it from the Chart of Accounts screen.

To make a GL account inactive

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Select the account you want to make inactive, and click Edit. The GL Account Edit screen opens. |

| 3. | Clear the Active check box, and click OK. The Chart of Accounts screen opens. |

| 4. | Close the Chart of Accounts screen. |

If you’ve never used a general ledger account, you can delete it from the Chart of Accounts.

To delete a general ledger account

| 1. | Select General Ledger > Chart of Accounts. The Chart of Accounts opens. |

| 2. | Select the account you want to remove, and click Delete. A confirmation message appears. |

| 3. | Click Yes. |