Fees

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

With fees, you can track money that isn't a tax that's owed to a government entity. Examples of fees include state tire fees and state tire tax. Fees require special handling to ensure the money collected is not included in your income. Like sales tax, fees need to be treated as a payable.

Set Up Fees

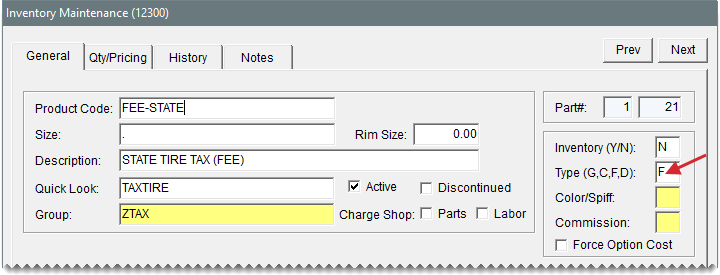

Fees are usually set up as noninventoriable items. To classify an item as a fee, type the letter F in the Type (G, C, F, D) field on the Inventory Maintenance screen.