Tax Exemption Certificates

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

If your state requires additional documentation for tax-exempt customers, you can create a tax exemption certificate that can be printed on invoices for tax‑exempt customers.

Creating a tax exemption certificate includes defining the certificate text and adding a signature line..

To create a tax exemption certificate

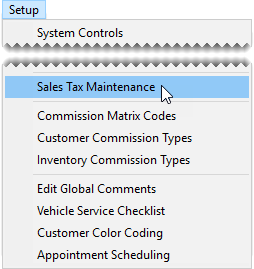

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

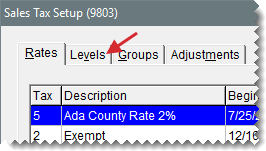

| 2. | Click the Levels tab. |

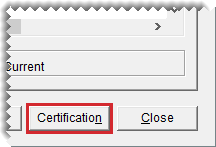

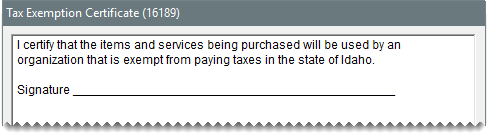

| 3. | Click Certification. The Tax Exemption Certificate screen appears. |

| 4. | Type the certificate text and a signature line. |

| 5. | To save the certificate, click OK. |

| 6. | Close the Sales Tax Setup screen. |

Tax exemption certificates can be printed on invoices for tax-exempt customers at point of sale.

To print a tax exemption certificate

| 1. | Turn a work order into an invoice. For more information, see Complete an Invoice. |

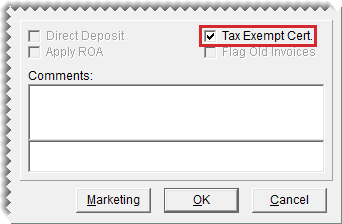

| 2. | Select the Tax Exempt Cert check box on the Invoice Completion screen. |

| 3. | Complete the invoice as usual. The printed invoice will include the text from the tax exemption certificate. |