Special Tax Requirements

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

Some states require businesses to charge a percentage of the regular tax rate for certain items. For example, retreads might be taxed at 75% of the regular rate. If you conduct business in a state with this type of tax requirement, you need to set up one or more tax rate adjustments in TireMaster.

Setting up tax rate adjustments includes the following steps:

Creating one or more inventory tax adjustment groups

Creating one or more tax rate adjustments, to define which tax rate and items are affected by an adjustment

With a tax rate adjustment, only the tax on the parts price is adjusted. Labor and federal excise tax are calculated as usual. If you’re unsure of whether you need to set up tax rate adjustments, talk to your accountant.

An Inventory tax adjustment group is a collection of items that need to be taxed at a percentage of the regular tax rate. Inventory adjustment groups can be assigned to tax rate adjustments.

When you create an inventory tax adjustment group, look up and assign the items that need to be included in the group.

To create an inventory tax adjustment group

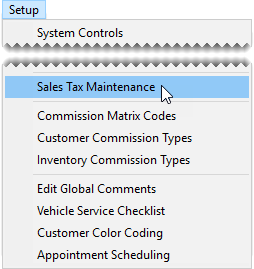

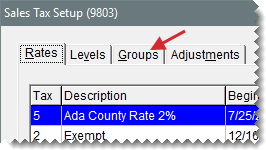

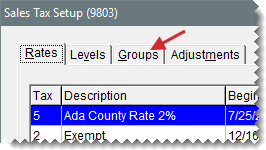

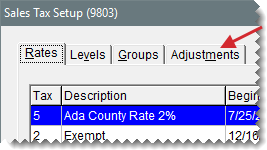

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

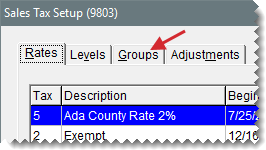

| 2. | Click the Groups tab. |

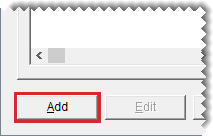

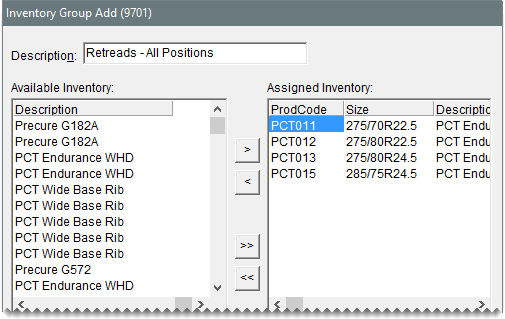

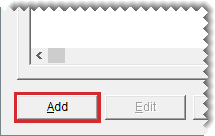

| 3. | Click Add. The Inventory Group Add screen opens. |

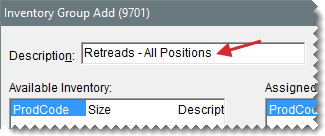

| 4. | Type a description for the inventory tax adjustment group. |

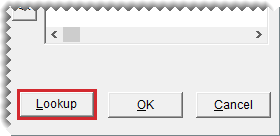

| 5. | Click Lookup, and look up items that you want to include in the inventory tax adjustment group. For more information, see Inventory Searches. |

| 6. | Assign items to the tax adjustment group: |

For a single item, select it and click  .

.

For all items, click  .

.

. To remove all items, click

. To remove all items, click  .

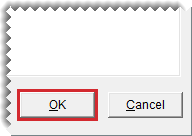

.| 7. | To save the new tax adjustment group, click OK. |

If you need to add or remove items from an inventory tax adjustment group, you can update the group.

To update an inventory tax adjustment group

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

| 2. | Click the Groups tab. |

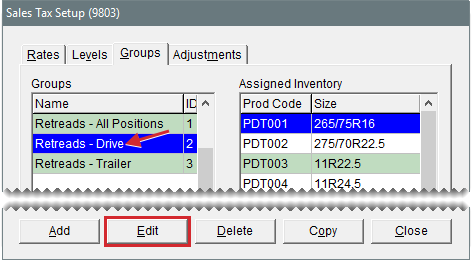

| 3. | Select the group you want to update and click Edit. |

| 4. | Add or remove items as needed: |

To add items, click Lookup and search for the items you want to add. For a single item, select it and click  . To add all items, click

. To add all items, click  instead. For more information, see Inventory Searches.

instead. For more information, see Inventory Searches.

To remove an assigned item, select it and click  . To remove all items, click

. To remove all items, click  .

.

| 5. | To save your changes, click OK. |

If an inventory tax adjustment group has never been used for a tax rate adjustment, you can delete it.

To delete an inventory tax adjustment group

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

| 2. | Click the Groups tab. |

| 3. | Select the group you want to remove, and click Delete. A confirmation message appears. |

| 4. | Click Yes. |

| 5. | Close the Sales Tax Setup screen. |

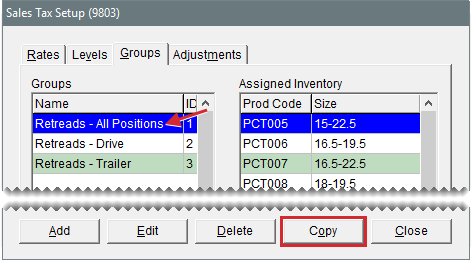

You can create a new inventory tax adjustment group by copying an existing group. Copying an existing group saves you time if the new group needs to have many of the same settings as an existing group.

To copy an inventory tax adjustment group

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

| 2. | Click the Groups tab. |

| 3. | Under Groups, select the group you want to copy and click Copy. The Inventory Group Copy screen appears. |

| 4. | Type a description for the new inventory tax adjustment group. |

| 5. | Add or remove items as needed: |

To add items, click Lookup and search for the items you want to add. For a single item, select it and click  . To add all items, click

. To add all items, click  instead. For more information, see Inventory Searches.

instead. For more information, see Inventory Searches.

To remove an assigned item, select it and click  . To remove all items, click

. To remove all items, click  .

.

| 6. | To save the new group, click OK. |

A tax rate adjustment is a setting that ensures that items are taxed at a percentage of the regular tax rate. Each tax rate can have only one tax rate adjustment.

The settings for a tax rate adjustment define which tax rate to adjust and which items are taxed at the adjusted rate. If you sell items that should be tax exempt for certain customers, you can set up an exempt tax rate adjustment. In this case, federal excise tax is exempt.

To create a tax rate adjustment

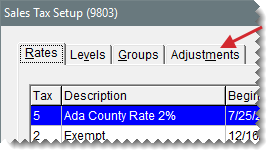

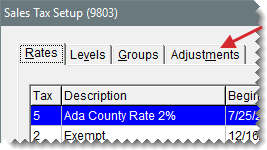

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

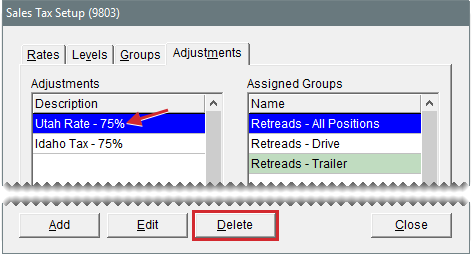

| 2. | Click the Adjustments tab. |

| 3. | Click Add. The Adjustment Add screen appears. |

| 4. | Enter the following information: |

| a. | Type a description for the tax rate adjustment. |

| b. | Define which rate will be adjusted by clicking the Tax Rate field, pressing  , and selecting a rate from the list. , and selecting a rate from the list. |

| c. | Define the percentage of an item’s price that will be taxed, by typing the number as a decimal in the Taxable Factor field. (For example, if 75% of the item’s price is taxable, type .75.) If the items assigned to this group should not be taxed, select the Exempt check box instead. |

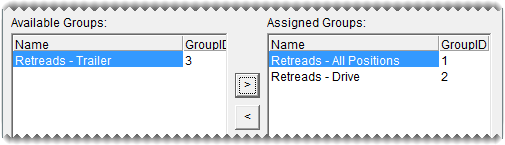

| 5. | Assign one or more inventory tax adjustment group to the adjustment: |

To assign a single inventory tax adjustment group, select the group, and click  .

.

To assign all inventory tax adjustment groups, click  .

.

. To remove all groups, click

. To remove all groups, click  .

.| 6. | To save the new tax rate adjustment, click OK. A message that lists the settings for the tax rate adjustment appears. |

| 7. | Review the settings described in the message, and do one of the following: |

If the settings are correct, click Yes.

If the settings are not correct, click No, and make the needed changes.

You can update a tax rate adjustment by changing its name, adding new inventory tax adjustment groups, and removing inventory tax adjustments groups.

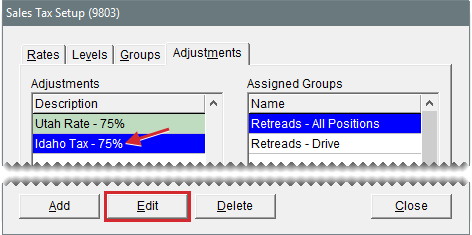

To edit a tax rate adjustment

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

| 2. | Click the Adjustments tab. |

| 3. | Select the tax rate adjustment that you want to update and click Edit. The Adjustment Edit screen appears. |

| 4. | Change the description and add or remove inventory tax adjustment groups as needed: |

To add a single inventory tax adjustment group, select the group, and click  . To assign all tax adjustment groups, click

. To assign all tax adjustment groups, click  .

.

To remove a single inventory tax adjustment group, select the group, and click  . To remove all inventory tax adjustment groups, click

. To remove all inventory tax adjustment groups, click  .

.

| 5. | To save the updated tax rate adjustment, click OK. |

If you no longer need to use a tax rate adjustment, you can make it inactive.

To make a tax rate adjustment inactive

| 1. | Select Setup > Sales Tax Maintenance. The Sales Tax Setup screen opens. |

| 2. | Click the Adjustments tab. |

| 3. | Select the tax rate adjustment that you want to make inactive, and click Delete. |

| 4. | Click Yes to confirm that you want to delete the tax rate adjustment. The following message appears: “This Adjustment has been associated with a tax level. To make it inactive, click OK. Otherwise click Cancel.” |

| 5. | Click OK. The tax rate adjustment is removed from the Sales Tax Setup screen. |