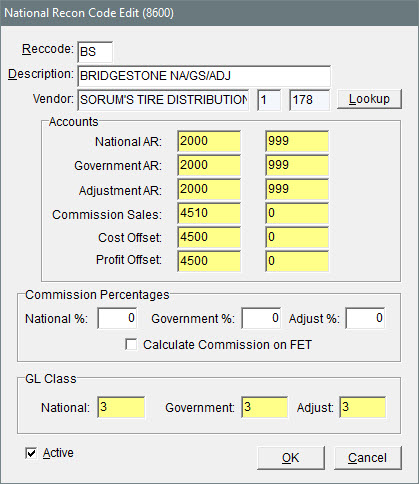

National Recon Code Edit Screen

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

Reconciliation codes are set up and managed on the National Recon Code Edit screen.

|

Item |

Description |

|

RecCode |

Let you enter a two-character code for tracking national-account, government-support, and adjustment sales. This code can, but doesn’t need to, match the vendor’s manufacturer code. |

|

Description |

Lets you enter a description for the reconciliation code. This description can, but doesn’t need to, include the name of the national vendor. |

|

Vendor |

Displays the name of the local vendor who distributes the national vendor’s products. |

|

Lookup |

Lets you look up and assign a local vendor to the reconciliation code. |

|

Accounts |

Includes fields for assigning general ledger accounts to the reconciliation code. |

|

National AR |

Lets you set the general ledger account for posting expected credits received from the selected vendor for national‑account sales. This account is usually a contra AP account (such as Accounts Payable - Expected Credits) or an AR account. |

|

Government AR |

Lets you assign the general ledger account for posting expected credits received from the selected vendor for government-support sales. This account is usually a contra AP account (such as Accounts Payable - Expected Credits) or an AR account. |

|

Adjustment AR |

Lets you assign the general ledger account for posting expected credits received from the selected vendor for adjustment sales. This account is usually a contra AP account (such as Accounts Payable - Expected Credits) or an AR account. |

|

Commission Sales |

Lets you assign the general ledger account for posting any commissions or handling fees received from the selected vendor. This account is usually a revenue or income account. |

|

Cost Offset |

Lets you assign the general ledger account for posting any losses for national-account, government-support, or adjustment invoices associated with the selected vendor. This account is usually an NA/GS/ADJ Gain/Loss account. Note: The loss is the difference between the expected credit and the actual credit.

|

|

Profit Offset |

Lets you assign the general ledger account for posting any gains for national-account, government-support, or adjustment invoices associated with the selected vendor. This account is usually an NA/GS/ADJ Gain/Loss account. Note: The gain is the difference between the expected credit and the actual credit.

|

|

Commission Percentages |

Includes fields for setting the commission percentages (handling fees) you expect from the vendor assigned to the reconciliation code. |

|

National% |

Lets you define the commission percentage (handling fee) you expect to receive for national‑account invoices. |

|

Government% |

Lets you define the commission percentage (handling fee) you expect to receive for government‑support invoices. |

|

Adjust% |

Lets you define the commission percentage (handling fee) you expect to receive for adjustment invoices. |

|

Calculate Commission on FET |

Lets you define whether to include federal excise tax (if any) in commission calculations. |

|

GL Class |

Includes fields for assigning a GL class to each type of sale. |

|

National |

The GL class for any national-account sales associated with this vendor. |

|

Government |

The GL class for any government-support sales associated with this vendor. |

|

Adjust |

The GL class for any adjustments associated with this account. |

|

Active |

Lets you define whether the reconciliation code is currently in use. |