Credit Reconciliation

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

When you receive a vendor credit for a national account, government support, or adjustment sale, you need to compare it to the expected credit to determine your profit or loss. In TireMaster, this process is called reconciliation.

A vendor credit for national account sales should reimburse you for roughly the entire amount of an invoice, in addition to any commissions or handling fees. Credits for government support agreements and adjustments can vary.

Reconcile a Vendor Credit

When you receive a vendor credit, compare it to the expected credit to determine your profit or loss.

To reconcile a vendor credit

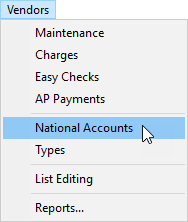

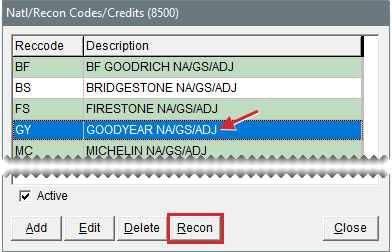

| 1. | Select Vendors > National Accounts. Then Natl/Recon Codes/Credits screen opens. |

| 2. | Select the reconciliation code for the vendor who issued the credit, and click Recon. The National Credits screen opens. |

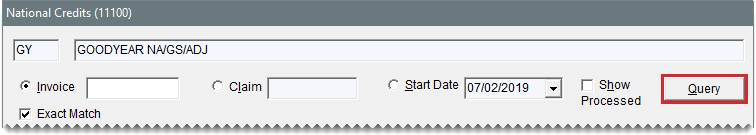

| 3. | Retrieve the invoice associated with the credit: |

Click Invoice and type the number of the invoice you want to view. For a specific invoice, make sure the Exact Match check box is also selected.

Click Start Date and select or type a start date.

Click Claim and type the claim number from an adjustment invoice or the reference number from a national account or government support invoice.

| 4. | Click Query. All available credits for the vendor appear. |

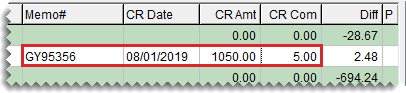

| 5. | Fill in the following information for the credit you want to reconcile: |

Memo#: This number should appear on the vendor credit memo you receive.

CR Date: This date is when the credit actually posted.

CR Amount: This value should be the actual credit amount not including any commission.

CR Com: This value is the actual commission you receive from the vendor.

| 6. | Click Process Credit on Selected Line. |

| 7. | Click Yes to confirm that you want to complete the credit memo. |

| 8. | Close the National Credits screen. |