Sales Tax Adjustments

This help topic is applicable to the following TireMaster applications:

If you collected the wrong amount of sales tax from a customer, you can adjust the sales tax for the corresponding invoice. A tax rate adjustment does not alter the amount of sales tax that appears on the original invoice. If you charged too much sales tax, the adjustment produces a credit for the customer. Likewise, if you didn't collect enough sales tax, the customer will owe you money. In TireMaster Plus and TireMaster Corporate systems, a sales tax adjustment results in an adjusting journal entry.

Because sales tax adjustments post to customer accounts (subledgers), you need to reimburse customers if you reduced the sales tax for their invoices. If customers owe sales tax, send them statements so you can collect the additional tax money. To see how much sales tax customers owe, print the Unapplied Credit Report .

Note: The document type code ST is used to identify transactions in which the sales tax has been changed for an invoice.

To make a sales tax adjustment

|

1.

|

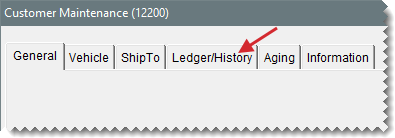

Look up the customer whose invoice needs a sales tax adjustment. For more information, see Customer Searches. |

|

3.

|

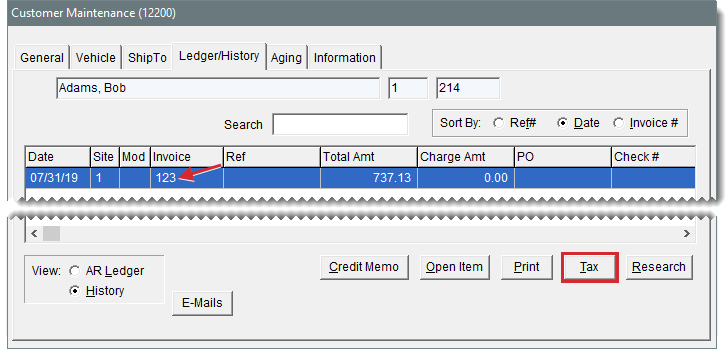

Select the invoice for which you want to change the sales tax amount, and click Tax. The Sales Tax Adjustment screen opens. |

|

4.

|

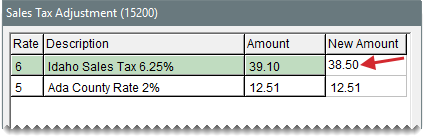

To change the amount of tax assessed for a particular rate, select the rate and type the new sales tax amount in the New Amount column. For rates that do not need to be changed, leave the entries in the New Amount field alone. |

|

5.

|

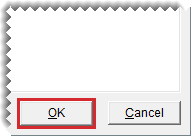

Click OK. A confirmation message appears. |

|

6.

|

To process the changes, click Yes. |

Note: Changing the tax rate does not alter the amount of sales tax that appears on the original invoice. It creates an entry in the customer's account instead. In TireMaster Plus and TireMaster Corporate, it also results in an adjusting journal entry.

|

7.

|

If you reduced the tax, reimburse the customer for the difference between the old amount and the new amount. If you increased the tax, send a statement to the customer so you can collect the additional tax owed. For more information, see Customer Reimbursements. |