Sales Commission Adjustments

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

If the vendor credit received for a national account, government support, or adjustment invoice does not match the expected credit, you might have paid too much or too little sales commission to an employee. You can ensure that the primary salesperson receives the proper commission by adjusting the sales commission amount. The sales commission for an invoice can be adjusted only once.

Before you can adjust the amount of sales commission paid to the primary salesperson for a national account, government support, or adjustment sales, you need to complete a pair of settings in System Controls.

To enable sales commission adjustments

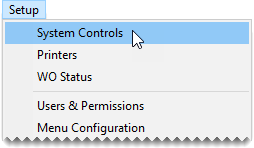

| 1. | Select Setup > System Controls. The System Controls screen opens. |

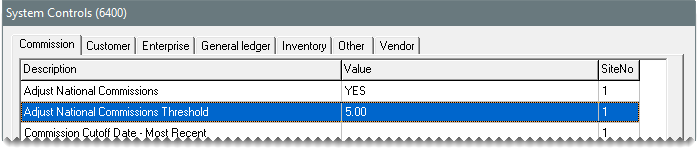

| 2. | Make sure the Commission tab is selected. |

| 3. | To enable commission adjustments, do the following: |

| a. | Select Adjust National Commissions and press Enter. |

| b. | Select Yes and click OK. |

| 4. | To set the commission threshold, do the following: |

| a. | Select Adjust National Commission Threshold and press Enter. |

| b. | Type the amount you want to set for the commission threshold and click OK. |

| 5. | Close the System Controls screen. |

You can change the amount of sales commission paid to the primary salesperson when there is a difference between the expected vendor credit and actual credit received for a national account, government support, or adjustment sale.

To adjust sales commission for a special sale

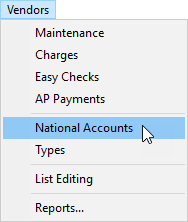

| 1. | Select Vendors > National Accounts. The Natl/Recon Codes/Credits screen opens. |

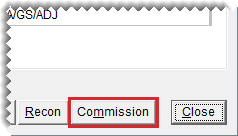

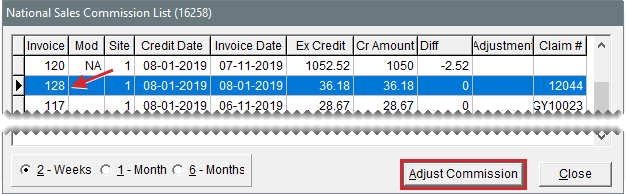

| 2. | Click Commission. The National Sales Commission List opens. |

| 3. | Select one of the following options: |

To view invoices whose vendor credits were reconciled during the past two weeks, select 2 -Weeks.

To view invoices whose vendor credits were reconciled during the past month, select 1 - Month.

To view invoices whose vendor credits were reconciled during the past six months, select 6 - Months.

| 4. | Select the invoice whose sales commission you want to adjust, and click Adjust Commission. The Sales Commission Adjustments screen appears and displays a suggested adjustment amount in the Sales Commission Adjustment field. |

| 5. | In the Sales Commission Adjustment field, do one of the following: |

To change the sales commission by the suggested amount, leave the value as is.

To reduce the sales commission, type a negative adjustment amount.

To increase the sales commission, type a positive adjustment amount.

| 6. | Type a note about the adjustment in the Sales Commission Comment field. This note prints on the Commission Report. |

| 7. | Click OK. |