Track Inventory Costs and Quantities

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

Before you add an item to the inventory, you need to decide whether you want to track its cost and quantities. Depending on the choice you make, you’ll classify the item as either inventoriable or noninventoriable.

If you need to keep track of an item’s cost and quantities, set it up as an inventoriable item. Inventoriable items include the items that you typically keep in stock and include in your physical inventory counts. If you want your sales reports to show the profit or loss for an item, set it up as inventoriable.

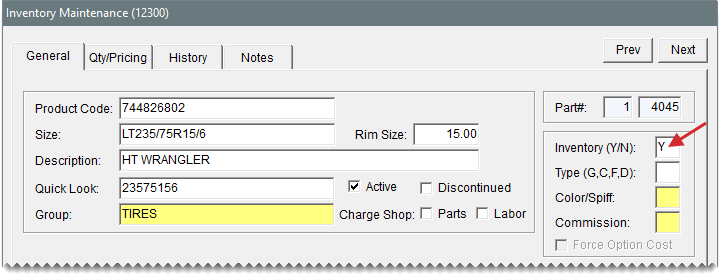

To classify an item as inventoriable, type the letter Y in the Inventory (Y/N) field on the Inventory Maintenance screen. To track changes in an inventoriable item’s cost, you need to select one of three inventoriable costing methods. For more information, see Inventoriable Costing Methods.

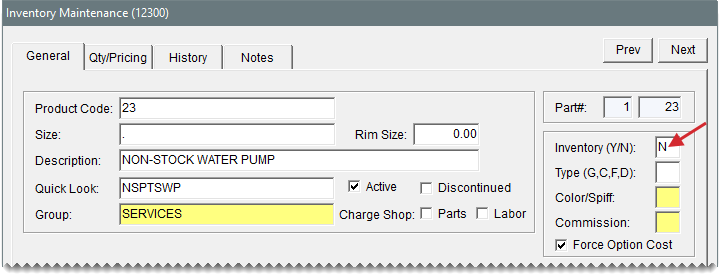

If you need to track an item’s cost but not its quantities, set it up a noninventoriable item. Noninventoriable items typically include labor, nonstock items such as service parts, and hard-to-track items such as valve stems.

To classify an item as inventoriable, type the letter N in the Inventory (Y/N) field on the Inventory Maintenance screen. When you set up a noninventoriable item, you also need to decide the following:

If you want to post the item’s cost to general ledger at point of sale (Option Cost Method).

If you want to post the item’s cost to the general ledger when you buy it from a vendor (Expense Method).

If you want to post the item’s cost to the general ledger when it’s sold (Relief Percent Method).

For more information, see Noninventoriable Costing Methods.