Taxed Credit Card Surcharges

This help topic is applicable to the following TireMaster applications:

|

TireMaster Point of Sale |

TireMaster Plus |

TireMaster Corporate |

|---|---|---|

|

|

|

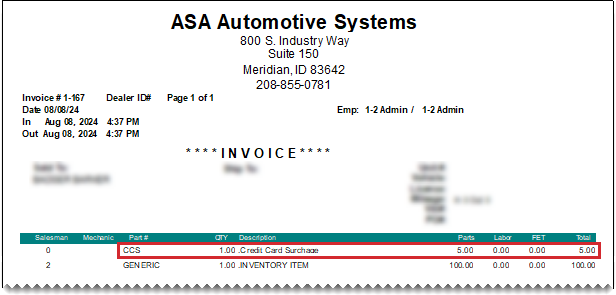

If you conduct business in a state that assesses sales tax on credit card surcharges, you can include a taxable surcharge line item on invoices and the tax on the surcharge will be compute and added to the invoice total. The surcharge calculation is based on the surcharge rate defined in System Controls and the invoice total.

Before you can assess sales tax on credit card surcharges, you need to add an item to your inventory and set a pair of system controls.

The credit card surcharge item is used to include the surcharge on sale invoices and calculate the surcharge sales tax.

To create a credit card surcharge item

| 1. | Begin the process of adding the item as usual. For more information, see Add an Inventory Item. |

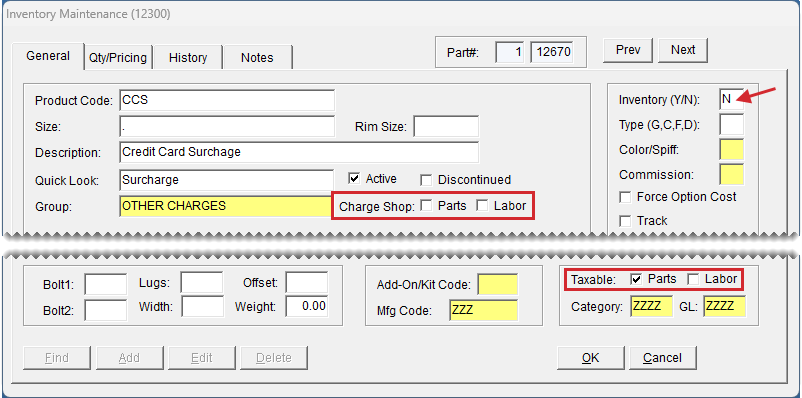

| 2. | Configure the shop charge, inventory status, and tax in the following manner: |

Make sure the Charge Shop Parts and Labor checkboxes are clear.

Type the letter N in the Inventory (Y/N) field.

Select the Taxable Parts checkbox. Make sure the Labor checkbox is clear.

| 3. | Click OK to save the new item. |

| 4. | When the prompt to view and edit the item's prices appears, click No and close the Inventory Maintenance screen. |

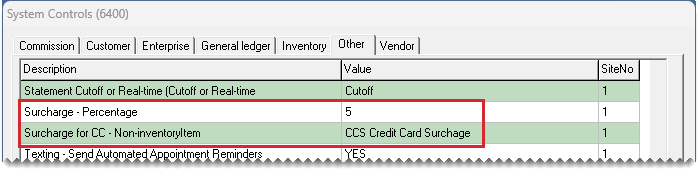

The system controls for taxing surcharges are used to define the surcharge item and to define the state's surcharge rate. In a multi-store environment, set this control for each store.

To set the surcharge controls

| 1. | Select Setup > System Controls. The System Controls screen opens. |

| 2. | Click the Other tab. |

| 3. | If you're working in a TireMaster Corporate environment, select Store Controls. Otherwise, disregard this step. |

| 4. | Define the surcharge rate. |

| a. | Select Surcharge - Percentage and press Enter. |

| b. | Type the rate as a whole number and click OK. |

| 5. | Define the surcharge item. |

| a. | Select Surcharge for CC - Noninventory Item and press Enter. The Custom Inventory Lookup screen opens. |

| b. | Search for the surcharge item and click OK. For more information, see Inventory Searches. |

| 6. | Close the System Controls screen. |

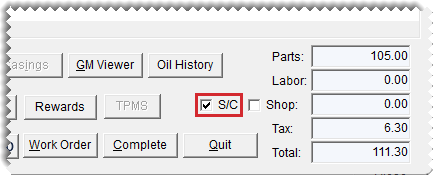

When it's time to finalize a sale, you can instruct TireMaster to calculate the surcharge prior to completing the invoice. The surcharge will appear as a line item on the printed invoice and the sales tax calculated for the surcharge will be added to the invoice total.

To assess sales tax on a credit card surcharge

| 1. | Retrieve the customer's work order. For more information, see Retrieve a Customer's Work Order |

| 2. | Ask the customer if they'll be paying with a credit card. |

| 3. | Select the S/C checkbox. |

| 4. | Click Complete. The Invoice Completion screen opens. |

| 5. | Enter the payment amount in one or more Credit/Debit fields and enter the payment amount. The Credit Card Authorization screen opens. |

| 6. | Type the card information or tell the customer to swipe the credit card. |

| 7. | Click OK. |

| 8. | Complete the invoice as usual. For more information, see Complete an Invoice. |